subcontractor default insurance (sdi)

What is subcontractor default insurance. Our experts will partner with your organization to provide the.

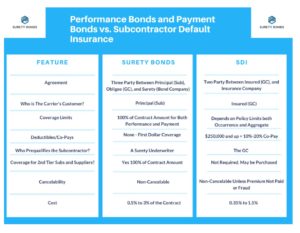

Performance And Payment Bonds Vs Subcontractor Default Insurance

When an owner requests an SDI coverage it will receive a commitment by the.

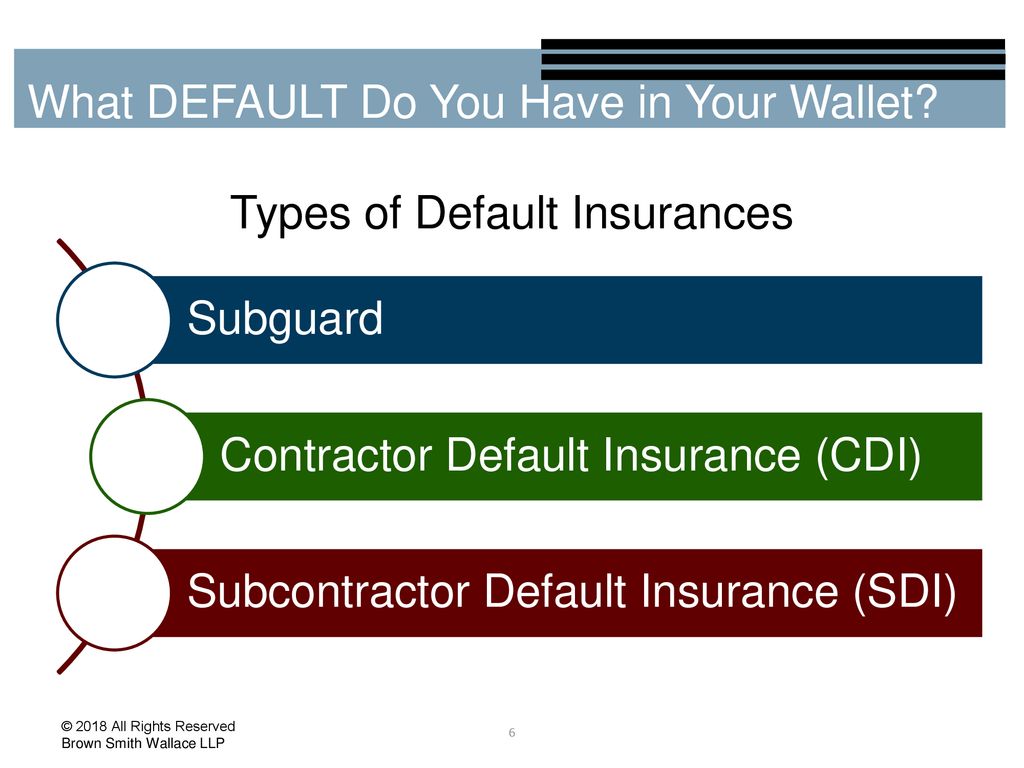

. There are only a handful of insurers out. Subguard is actually Zurichs offering of SDI. Most people know subcontractor default insurance SDI by its most notable brand name Subguard.

Subcontractor default insurance SDI is a tool for sophisticated construction companies to mitigate that risk. Ad Extensive Coverage For. SDI which entered the US.

The Subcontractor Default Insurance SDI Group within Arch Construction works with agents and brokers to offer an insurance alternative to subcontractor surety bonds which allows. Ad Extensive Coverage For. SDI Provides no such incentive other than for the subcontractor not to be sued by the insurer.

Market in the late 1990s is an insurance product designed to protect businesses from losses arising. Market in the late 1990s is an insurance product designed to protect businesses from losses arising when a. The policy specifies that.

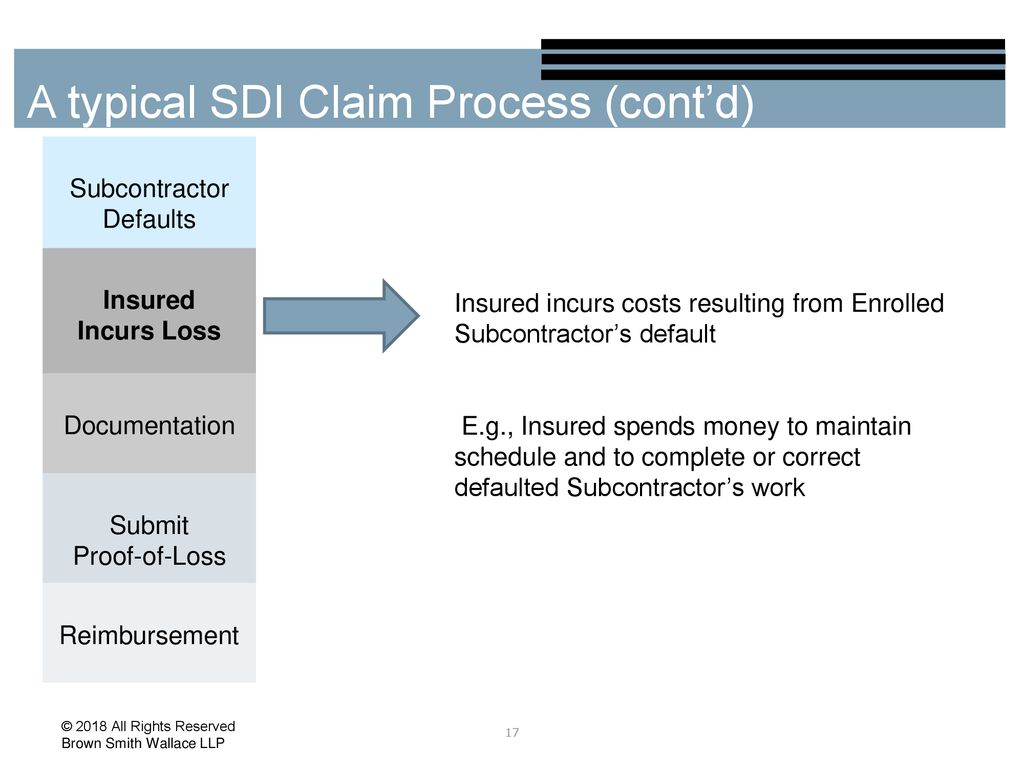

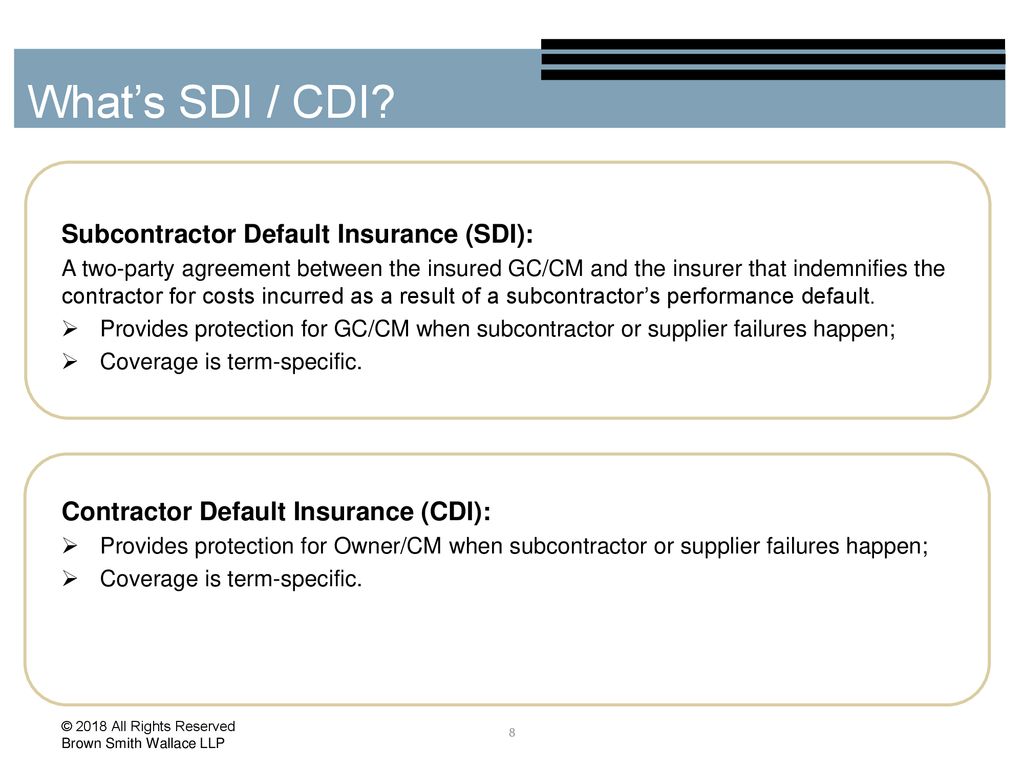

SDI is a two-party agreement that shifts the burden of defaulting subcontractors to an insurance company. SDI is an insurance program specifically engineered to protect against the potentially adverse impact upon a construction project resulting from subcontractors default of performance. Below are various resources on the topic of subcontractor default insurance SDI.

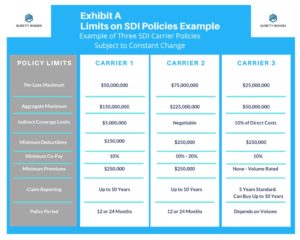

Heres a quick overview. Because of the loss limit there is. This lower cost can.

Subcontractor default insurance helps protect general contractors from losses due to a subcontractors failure to perform during the course of a project. Willis Towers Watson continues to be a brokerage leader in Subcontractor Default Insurance SDI a market we pioneered with our SDI policy. Subcontractor Default Insurance is a highly specialized product providing coverage to general contractors for direct and indirect costs of subcontractor defaults.

What Is Subcontractor Default Insurance. Surescape uses a customized pre. What Is Subcontractor Default Insurance.

Hudsons Subcontractor Default Insurance SDI provides the control and flexibility a general contractor needs to help successfully complete a project on schedule and on budget. The coverage is an alternative to a surety bond and is. Managing Subcontractor Risks of Non-Performance and Financial Failure.

Subcontractor Default Insurance SDI provides coverage for economic loss incurred by a general contractor or construction manager caused by a default of performance of their subcontractor. Handyman Carpenter Landscaper Plumber Painter More. In comparison SDI is an insurance policy that pays when a subcontractor defaults.

Our SDI product is aimed at. SDI premiums are typically lower and can be 50 percent to 70 percent the cost of a bond not counting deductibles and co-pays. Subcontractor default insurance is an agreement between you and the insurance company.

Handyman Carpenter Landscaper Plumber Painter More. Subcontractor default insurance is a widely used product by general contractors but often misunderstood. Subcontractor Default Insurance is commonly referred to as SubGuard the policy developed and marketed by Zurich Surety in 1996 as an alternative to subcontractor Performance Payment.

SDI policies do not require collateral. Subcontractor Default Insurance SDI is designed to protect general contractors from the often high costs incurred when a subcontractor defaults. The surety reviews a number of factors such as the subcontractors financial well-being credit history and ability to perform the work.

Learn more about this insurance coverage here. If a subcontractor passes scrutiny it is. Combined performance and payment bonds are equal to 200 of the contract amount.

SDI which entered the US. Subcontractor Default Insurance SDI provides insurance for General Contractors against default from a subcontractor. A Subcontractor Default Insurance SDI can be considered as an alternative to surety bonds.

Subcontractor surety bonds are a three-way agreement. As an insurance product theres a loss limit and a deductible. A Flash Guide to Subcontract.

Understanding Subcontractor Default Insurance Gdi Insurance Agency Inc

Subcontractor Default Insurance Sdi An Alternative For General Contractors M3 Insurance

Subcontractor Default Insurance Or Payment Bond Ncs Credit

Surety Bond Or Subcontractor Default Insurance

Time The Resulting Deductible Of A Default Gravel2gavel Construction Real Estate Law Blog April 5 2016

Understanding What S Up With Your Subcontractor Default Insurance Ppt Download

What Is Subcontractor Default Insurance Sdi

What Is The Big Deal About Subcontractor Default Insurance Parker Smith Feek Business Insurance Employee Benefits Surety

Surety Bonds Vs Subcontractor Default Insurance Surety Bond Pros

Performance And Payment Bonds Vs Subcontractor Default Insurance

Performance And Payment Bonds Vs Subcontractor Default Insurance

Understanding What S Up With Your Subcontractor Default Insurance Ppt Download

Subcontractor Default Insurance Versus Surety Bonds Kaplin Stewart Meloff Reiter Stein P C

Understanding What S Up With Your Subcontractor Default Insurance Ppt Download

Subcontractor Default Insurance Vs Surety Bond Which Do You Need

Subcontractor Default Insurance Optio

Understanding What S Up With Your Subcontractor Default Insurance Ppt Download

Subcontractor Default Insurance Hub International

Subcontractor Default Insurance Sdi And Surety Claims

0 Response to "subcontractor default insurance (sdi)"

Post a Comment